Proven Methods for Developing a Tailored Financial Debt Management Plan to Attain Financial Freedom

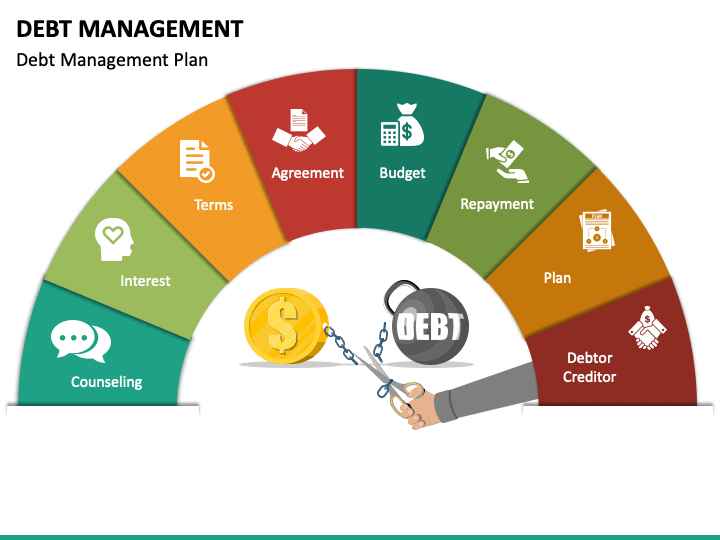

In the mission for financial liberty, the relevance of a well-crafted debt management plan can not be overemphasized. The journey towards attaining a debt-free life is a meticulous procedure that calls for cautious factor to consider and strategic planning. By applying proven approaches tailored to your unique financial scenario, you can lead the means for an extra safe and secure and stable future. From examining your existing financial standing to discovering and setting attainable goals consolidation choices, each step plays a crucial role in guiding you in the direction of your ultimate economic goals. However, the essential exists not only in the preliminary formulation of a plan however additionally in the recurring surveillance and needed modifications called for to remain on program.

Assessing Your Existing Financial Circumstance

Analyzing your present monetary standing is a crucial initial step in the direction of achieving lasting economic stability and flexibility. By conducting a thorough assessment of your earnings, expenditures, assets, and responsibilities, you can obtain a clear understanding of your general economic health.

In addition, it is vital to analyze your properties, such as savings accounts, retired life funds, and home, as well as any arrearages, consisting of bank card balances, home loans, and lendings. Determining your internet well worth by deducting your liabilities from your properties offers a photo of your financial position. This comprehensive evaluation establishes the foundation for creating a personalized debt monitoring strategy tailored to your particular monetary scenarios.

Establishing Realistic Financial Obligation Payment Goals

To attain financial freedom, developing functional financial obligation payment objectives is vital for individuals looking for to regain control of their finances. Setting realistic financial debt repayment goals entails a calculated method that thinks about both long-term and short-term economic targets.

When establishing financial debt repayment goals, it is vital to be particular, quantifiable, possible, appropriate, and time-bound (CLEVER) For instance, purpose to repay a specific amount of debt within a specific timeframe, such as decreasing bank card debt by $5,000 within the next six months. Damaging down bigger objectives into smaller sized turning points can aid track progress and preserve inspiration.

Additionally, consider readjusting your spending habits to allot even more funds in the direction of financial debt repayment. Producing a budget that details expenditures and earnings can highlight locations where savings can be made to speed up financial obligation reward. Consistently evaluating and changing your debt settlement objectives as required will guarantee continued progress towards economic freedom.

Producing a Personalized Budget Plan Strategy

Checking Out Financial Debt Combination Methods

When thinking about debt combination methods, it is vital to evaluate the different options offered to determine one of the most suitable method for your monetary scenarios. Debt combination entails incorporating several financial debts into a single lending or layaway plan, commonly with a reduced rate of interest, to make it much more convenient to pay back. One you can find out more typical technique is to obtain a loan consolidation finance from a financial institution to repay all existing financial obligations, leaving just one regular monthly settlement to concentrate on.

Another technique is financial debt administration via get more a credit rating therapy company. These companies deal with lenders to bargain reduced rate of interest or month-to-month settlements in your place. debt management plan singapore. Nonetheless, it's important to research and select a reliable company to stay clear of scams or additional monetary problems

Discovering financial obligation combination methods enables individuals to improve their financial obligation repayment, possibly minimize rate of interest prices, and work towards financial flexibility.

Monitoring and Readjusting Your Plan

Preserving an attentive eye on your financial debt management approach is vital for long-lasting financial success. Consistently monitoring your plan enables you to track your development, recognize any kind of deviations from the initial approach, and make essential changes to stay on program towards accomplishing your economic objectives.

Life scenarios, monetary priorities, and unanticipated costs can all affect your debt management approach. Bear in mind, a receptive and dynamic method to monitoring and changing your debt monitoring strategy is vital to lasting economic stability.

Final Thought

In conclusion, establishing a customized debt administration strategy is vital for attaining economic liberty. By analyzing your present financial scenario, establishing reasonable financial debt repayment goals, creating an individualized budget strategy, discovering financial obligation loan consolidation strategies, and monitoring and adjusting your strategy as required, you can efficiently handle your financial debts and work towards a debt-free future. It is essential to focus on economic security and make informed choices to enhance your general economic well-being.

In the quest for economic freedom, the significance of a well-crafted debt administration strategy can not be overemphasized. By adhering to a tailored budget strategy, individuals can take control of their visit our website financial situation, minimize financial debt, and development towards monetary freedom.

Remember, a receptive and dynamic strategy to tracking and readjusting your financial debt administration strategy is key to long-lasting financial stability.

In conclusion, establishing a customized debt monitoring plan is crucial for achieving financial liberty. By evaluating your present economic scenario, establishing practical debt payment goals, developing a personalized budget strategy, discovering financial debt loan consolidation strategies, and tracking and changing your plan as needed, you can successfully handle your financial debts and job in the direction of a debt-free future.

Comments on “The Ultimate Guide to Selecting the very best Debt Management Plan Singapore”